Growing Technology Companies:

Analysis of top 25 companies (2007 -2010)

Sometimes looking backwards can help to forecast future trends, though black swans can also emerge. CNN has listed the Fortune 500 ranked top performing technology companies over the past 3 years and serve as a model for what channels, sectors and geographic areas represent growing regions. The following analysis was done on the top 25 companies based on profits and revenues. The data should be taken with a grain of salt as it represents a small sample size of only 25 companies, and is also more representative of an economy during a recession. Thus, not all opportunities may be reflected during times of growth. However, economic forecasts do not anticipate western markets to recover to pre-recession levels in the short term. The analysis serves as a basis to predict some claims as to where companies and venture capitalists can look to invest in growing geographic areas or sectors. The analysis also helps to show what areas are growing and specializing for great recruitment talent pools within those technology sectors or channels.

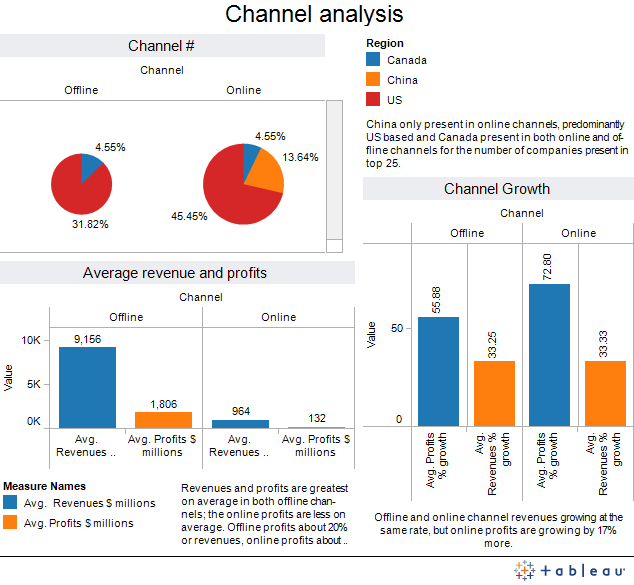

Technology Channel Analysis

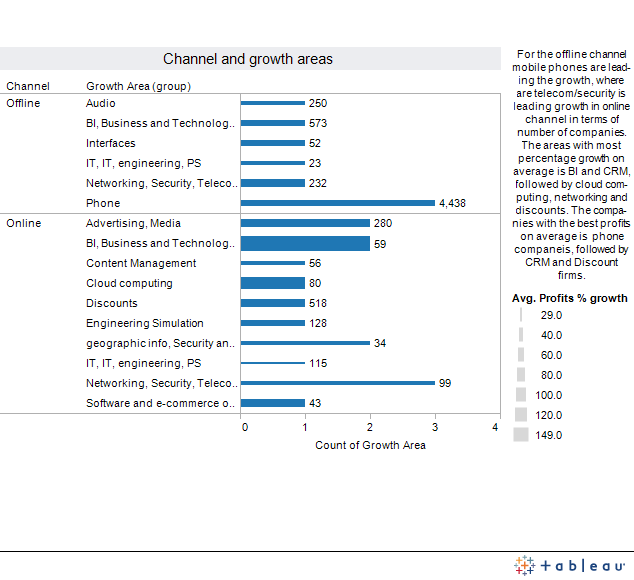

In channel and growth areas, the bars represent the profits and the thickness is the growth in profits. The best businesses are those with highest profits and growth.

(Clicking on the below graphs will provide interactive charts, small summaries are also included)

The channels show that profits seem to be lower for online companies but growth is higher. This may be due to the fact they are just younger and haven’t established the barriers to entry or squeezed more value out of the profit chain, as viewed through Porters 6 forces. Online represents the best growing trend, with higher profit margin once firms become established.

The channels show that profits seem to be lower for online companies but growth is higher. This may be due to the fact they are just younger and haven’t established the barriers to entry or squeezed more value out of the profit chain, as viewed through Porters 6 forces. Online represents the best growing trend, with higher profit margin once firms become established.

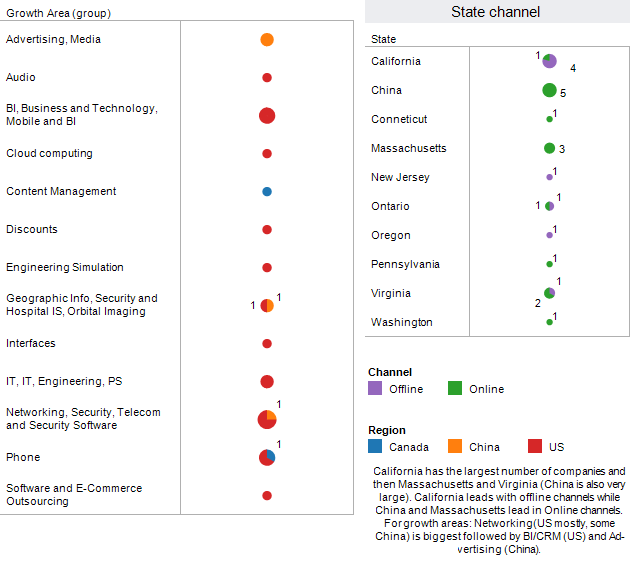

Technology Segment and Geographic Analysis

For the online channel, Massachusetts seems to be the best location, otherwise areas in China. Growth areas seem to indicate Networking and BI/CRM in the USA and Advertising and Networking for China.

For the online channel, Massachusetts seems to be the best location, otherwise areas in China. Growth areas seem to indicate Networking and BI/CRM in the USA and Advertising and Networking for China.

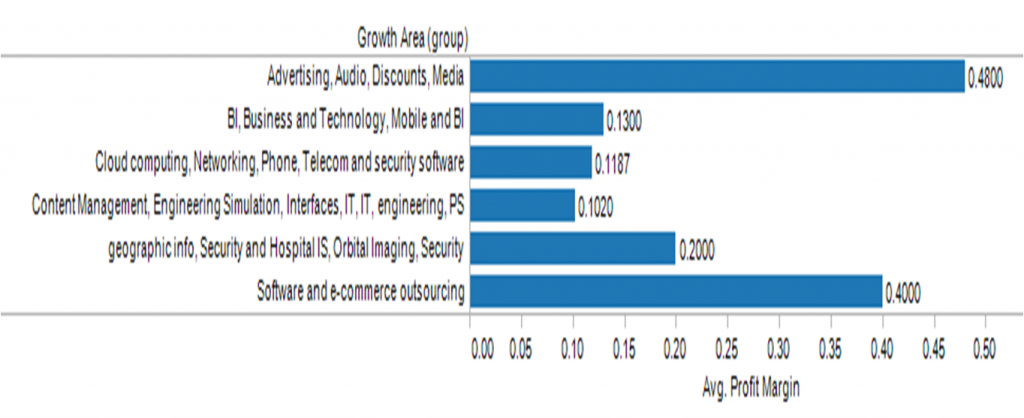

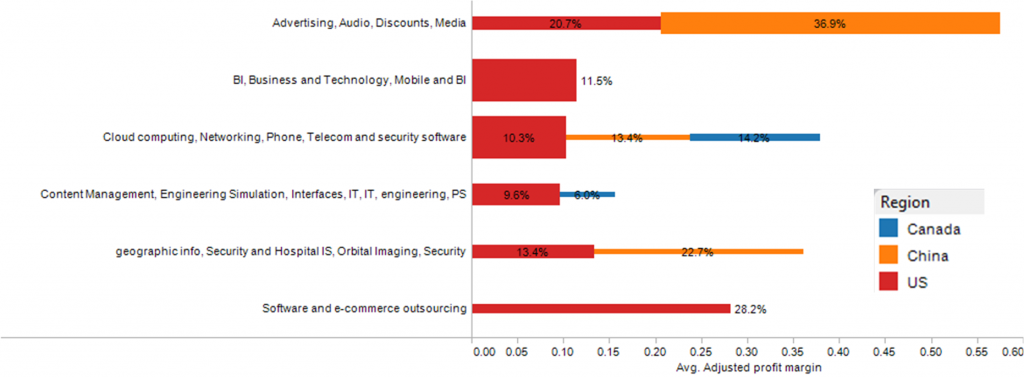

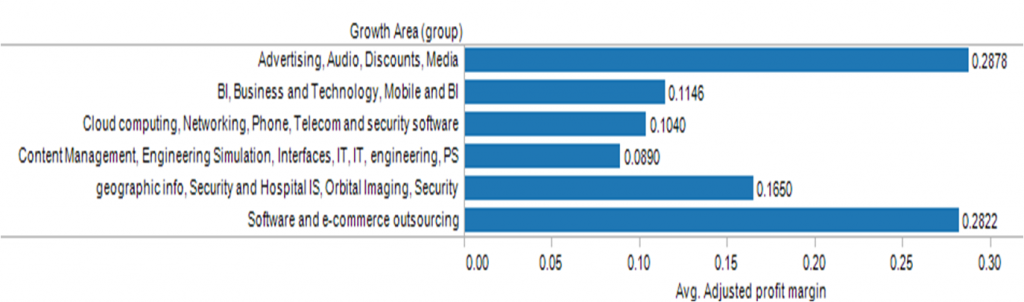

The biggest profit margin is shown in the media sector, followed by the software and e-commerce outsourcing, and then security and BI/CRM. When the data is adjusted by the profit growth margin (profits – growth in profits; to see profits not attributable to growth in profitability of the sector) then the results are as follows:

The biggest profit margin is shown in the media sector, followed by the software and e-commerce outsourcing, and then security and BI/CRM. When the data is adjusted by the profit growth margin (profits – growth in profits; to see profits not attributable to growth in profitability of the sector) then the results are as follows:

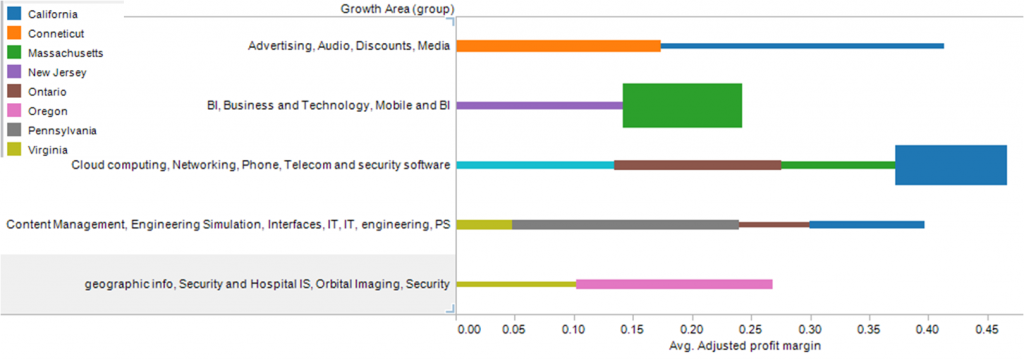

The results indicate that Media is still a lucrative market, with software outsourcing close behind. After that would be BI/CRM. Then once the information is broken down into regions we can see that China definitely has the best profit margins in almost all sectors, yet software outsourcing and media are still profitable in the USA, while Canada seems to be best for Telecom. However, when we look at growth, the North American markets seem to indicate the biggest profit increases, especially in BI/CRM and followed by telecom and IT/PS. China seems to indicate good growth and profitability in its Media sector (the thickness of the bars represents the growth % and the colors represent the average profitability in the growth areas for a given country).

When areas are subdivided into states, we can see that California is growing the most in Telecom and Massachusetts is more focused on BI/CRM.

When areas are subdivided into states, we can see that California is growing the most in Telecom and Massachusetts is more focused on BI/CRM.

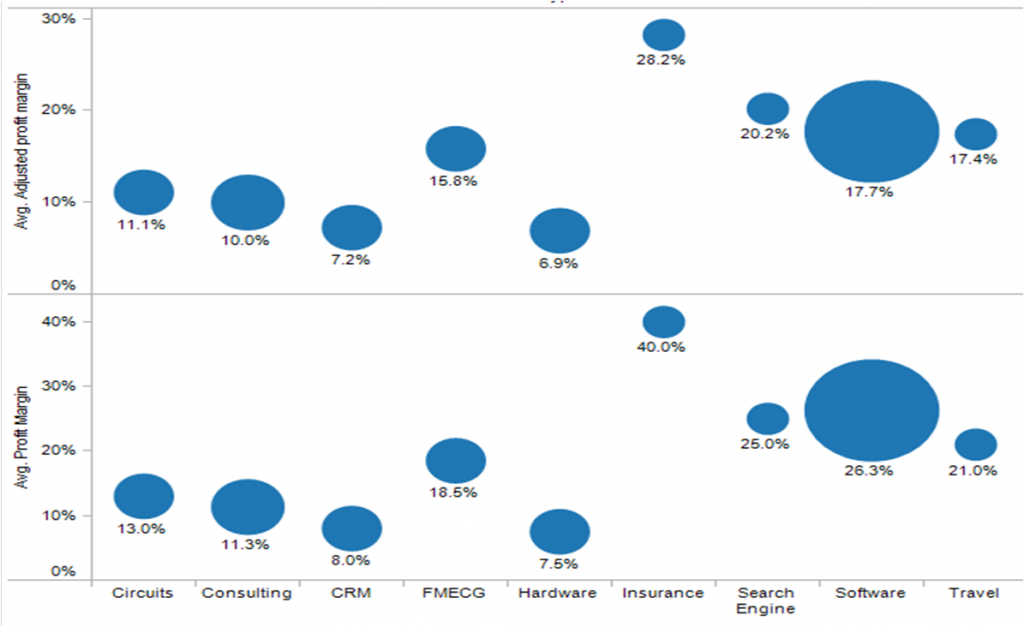

When we break it down into industry types we get the following:

The size of each circle represents the number of firms in the sample set, and as such is probably an indication that these types of firms are growing more or are more profitable. The average adjusted profitability displays the following: software is pretty good, but insurance being the best, followed by search engine and travel. The worst would be hardware and CRM. When we look at the regional breakdown we get the following:

The size of each circle represents the number of firms in the sample set, and as such is probably an indication that these types of firms are growing more or are more profitable. The average adjusted profitability displays the following: software is pretty good, but insurance being the best, followed by search engine and travel. The worst would be hardware and CRM. When we look at the regional breakdown we get the following:

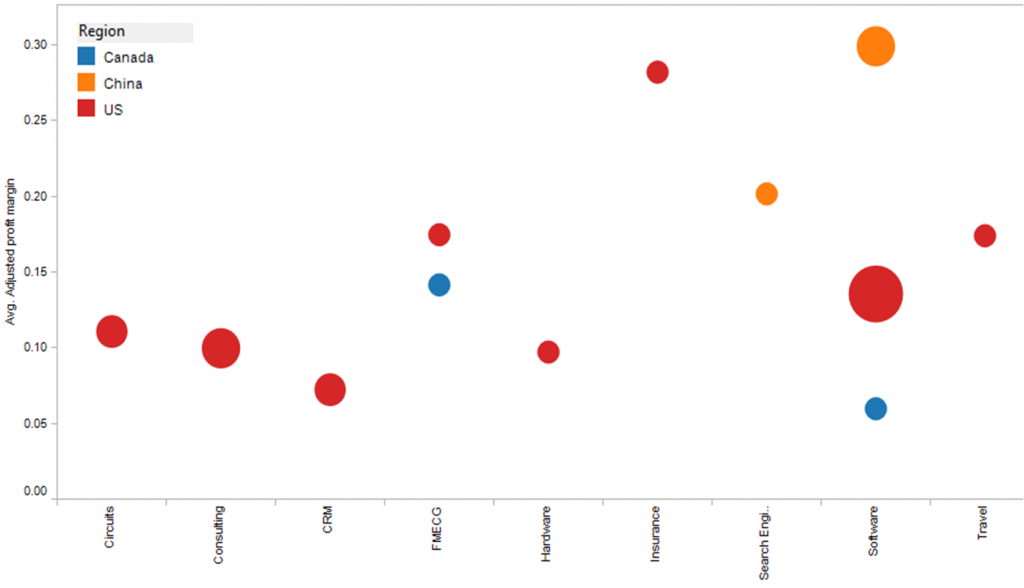

Thus, the most profitable software areas are in China, followed by insurance in the US, and search engine in China and again software in US.

Thus, the most profitable software areas are in China, followed by insurance in the US, and search engine in China and again software in US.

Recommendations

The data seems to indicate that the growing areas are Networking, IT/PS and BI/CRM in the USA, and Advertising and Networking for China. The profitable industries for China are in software outsourcing and media. The USA and Canada are profitable within the Telecom and software online channels, and FMECG and insurance offline channels. Within the USA, Massachusetts has the most successful online companies and are predominately within the BI/CRM segment. Where as California is predominantly offline and within the Telecom segment. As such, companies should look towards investment in these growing areas and setting up business or partnership with companies in those geographic regions. Additionally, the geographic information may indicate that those markets are demanding those types of products; China in particular.

I don’t know what to think.

this blog should someone print out and installed on every bicycle in paris